The pandemic has fueled a rollercoaster of ups and downs for shopping centers in America. And from a leasing perspective, keeping track of key trends is essential for success. We’ve compiled some stats we found interesting and surprising to help keep your team on track, and maybe even impress your CRE friends at a dinner party!

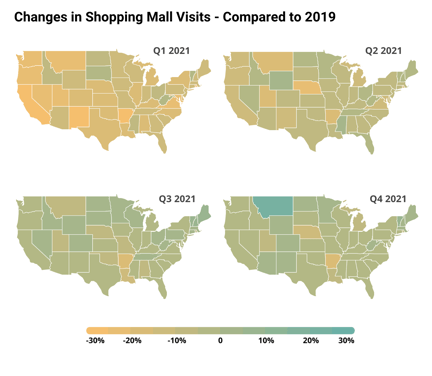

1. The most impressive comeback from 2020 is in the West: The graph below shows that almost all states saw a gradual Yo2Y visit growth throughout 2021 – but the most impressive comeback seems to have occurred in the West. California, Nevada, Oregon, and Washington all saw an increase in shoppers throughout 2021. Most notably, California closed the gap from 28.3% less shoppers to only 2.3% by Q4 compared to 2019.

2. Retail growth for 2022 is predicted to be between 6 and 8 percent: The 2022 figure compares with 14 percent annual growth rate in 2021, the highest growth rate in more than 20 years. The NRF forecasts that 2022 retail sales will total between $4.86 trillion and $4.95 trillion.

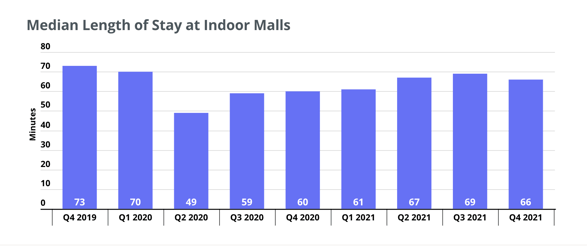

3. Mall visits are getting longer: But, they’re still not back up to their pre-pandemic levels. In Q4 2019, median mall visit length stood at 73 minutes. But in Q4 2021, the median visit length was 66 minutes, representing a nearly 10% drop. And Q4 2021 visits also fell compared to Q3 2021 – likely the result of the Omicron surge.

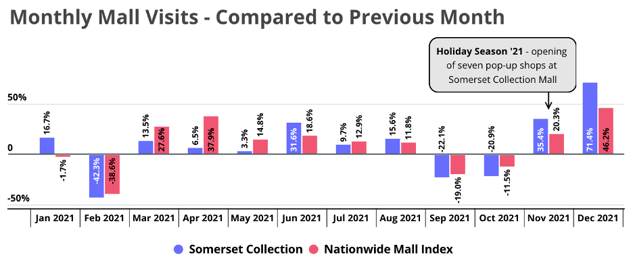

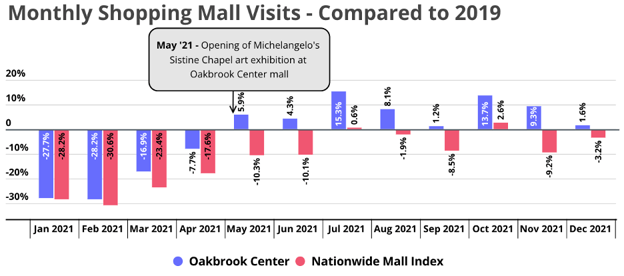

4. Malls are drawing people in with pop-up stores and exhibits. With an increase in vacancies due to the pandemic, mall owners have needed to get creative with the empty space. The examples below show how two malls used events to attract more customers. In late November and early December, the Somerset Collection mall near Detroit opened seven pop-up stores for the 2021 holiday season and saw a MoM visit hike of 71.4% – compared to the 46.2% average MoM increase for indoor malls nationwide. And Oakbrook Center near Chicago opened an art exhibit about the Sistine Chapel in May and saw an increase in visits for the remainder of the year. This strategy of creating a sense of urgency for a limited time event is one we expect to stick around - see our previous blog post about pop-up stores here.

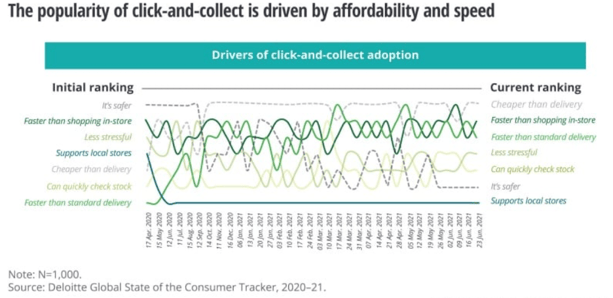

5. Consumers are getting used to buying online & pick-up in store. Brands with both an online presence and a physical location are in a position to do well! (https://www2.deloitte.com/us/en/insights/industry/financial-services/future-of-shopping-malls.html)

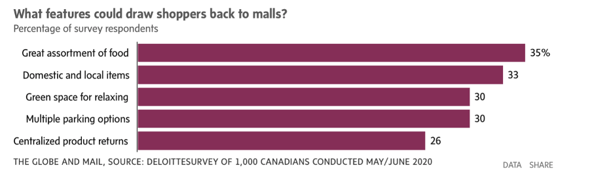

6. The mix of retail stores in malls is changing. If you’ve noticed that the mall near you is changing … then you’re right! In the past as much as 70% of the stores in a typical mall were allocated to soft goods retailers selling footwear and apparel. But that is changing since we simply aren’t spending as much on clothing as we used to. In 1920 Americans spent 38% of their income on food and 17% on clothing. Today Americans only spend 10% of their income on food and they spend even less on clothing, just a paltry 2.4%.(https://www.indigo9digital.com/blog/shoppingmalltrends)

Were these stats helpful for your business? We’d love to hear from you! Reach out to your customer success manager or schedule a demo with the Resquared team for more CRE insights.